Keep Fraudsters Out: OutSystems and HyperVerge are Improving Identity Verification for Insurance Companies

In insurance, first impressions begin with trust—and trust starts with identity verification. But let’s be honest: the traditional manual process of reviewing ID documents, checking records, and waiting for human validation isn’t just slow—it’s vulnerable to errors and fraud. That’s why more insurance providers are making the switch to automated identity verification powered by facial recognition technology. It’s faster, more secure, and designed to meet the needs of both modern customers and compliance teams.

The Problem with Manual Verification

In a manual process, onboarding often requires multiple touchpoints: the customer submits their documents, a staff member manually checks the ID, verifies data, and flags any inconsistencies. It’s time-consuming, hard to scale, and leaves too much room for human error. As fraud tactics evolve and regulations become stricter, insurers can’t afford to rely solely on traditional methods. They need a system that’s smart, secure, and seamless.

The Power of Facial Recognition in an Automated Process

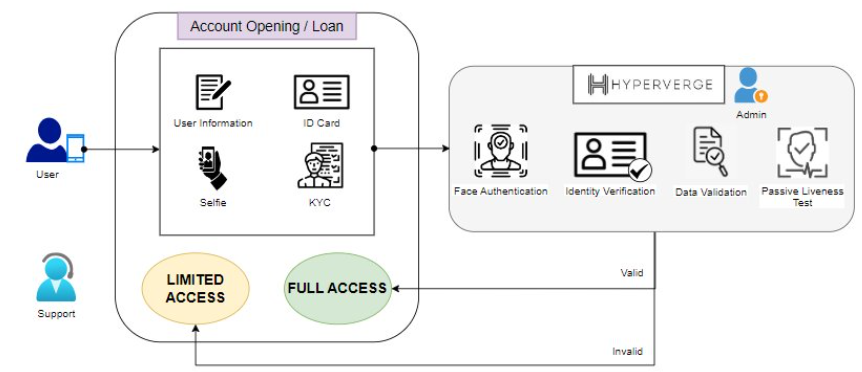

With OutSystems, a leading low-code platform, insurers can quickly build a digital onboarding workflow. When paired with HyperVerge, the process becomes fully automated and driven by facial recognition technology.

Here’s how it works:

- 1. Customers fill out an online form

- 2. They upload their government-issued ID

- 3. They take a quick selfie using their phone or webcam

- 4. HyperVerge instantly compares the photo to the ID using biometric analysis

In seconds, the system confirms the customer’s identity. If all checks pass, onboarding is completed. If something seems off, it’s flagged for manual review—keeping your team focused only on what truly needs attention.

Why It Matters Now More Than Ever

Customers expect quick and secure onboarding. Regulators expect accurate, traceable ID verification. And insurance teams are stretched thin—looking for tools that can reduce manual work without compromising control. By combining facial recognition with a well-designed automated process, you can deliver both speed and security. This approach reduces onboarding time by up to 70%, cuts error rates significantly, and strengthens fraud prevention efforts—all while improving the client experience.

By combining facial recognition with a well-designed automated process, you can deliver both speed and security. This approach reduces onboarding time by up to 70%, cuts error rates significantly and strengthens fraud prevention efforts—all while improving the client experience.

Final Thoughts

Moving from a manual process to an automated process isn’t just a tech upgrade—it’s a business advantage. With HyperVerge and OutSystems, insurers gain a smart, scalable way to handle identity verification with speed and confidence.

Let’s Help You Get Started

Curious how this works in practice? We’d love to walk you through it.

📩 Email us at marketing@infomax.com.ph

📞 Call us at (02) 8813-6721

Let’s make your identity verification smarter—with facial recognition that works for you and your customers.